If beating US economy by trillion $ every year is an indicator, China to emerge victor from trade war with US

I just returned from China after attending the first global Conference on Dialogue of Asian Civilizations (CDAC) in Beijing and the Asian Culture Carnival staged at Beijing’s Olympic Stadium. Both mega events were addressed by President Xi Jinping. I also had the chance to attend The Belt and Road Media and Think Tank Exchange Event in Nanjing later in the week.

I had the chance to speak at allied events in both Beijing and Nanjing, assessing China’s challenges in creating an Asian appeal, dealing with US (ongoing trade war, 5G technology and President Trump’s ban on Huawei, China’s technology and mobile giant) and reaching out to five billion non-Chinese-speaking.

Back home in Islamabad, I was able to attend a reception today for China’s Vice President Wang Qishan, who’s here to sign MoUs on CPEC.

This piece appeared on Op-Ed in The Nation, Islamabad, on 30 May 2019.

Since I mostly see future through a macroeconomic lens, I could assure my global audience in China that it is beyond US potential to stop China from rising to the world stage as the next economic superpower.

If beating US economy by a trillion dollar every year is an indicator, China is likely to emerge victor from trade war with US.

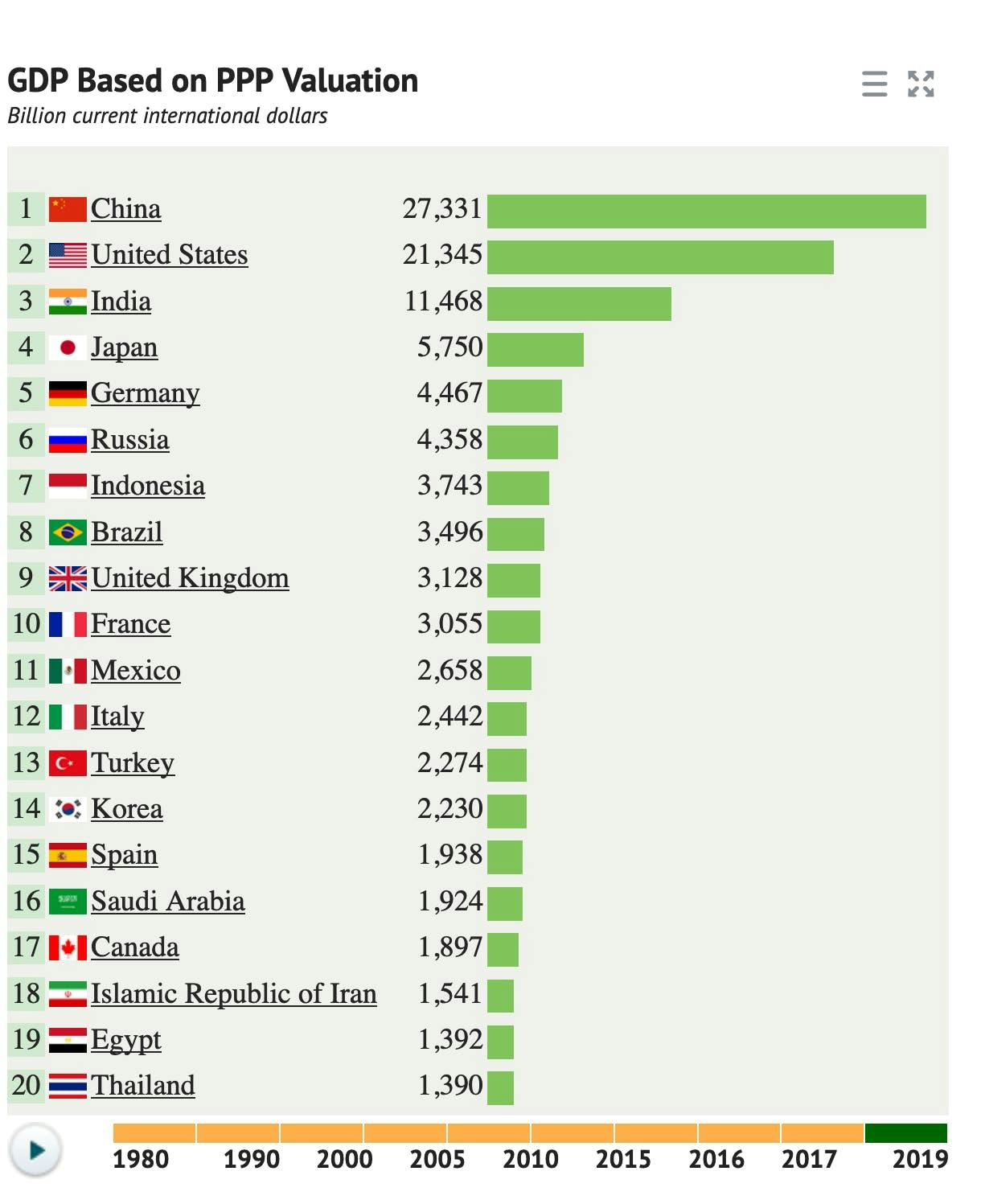

Here are my numbers:

Since 2014 when China first overtook the US economy by GDP purchasing power parity (PPP), China has been leaving the US economy behind by nearly a trillion dollar every year.

With $27.3 trillion in size by PPP in 2019, China is now $6 trillion ahead of the US, currently at $21.3 trillion, according to World Data Atlas which monitors the global economies through a variety of indicators.

The US had been the world’s largest economy for over 140 years. In 1872, the US had deprived Britain, then the world’s largest economy, of this title. In 2014, China did the same for the US.

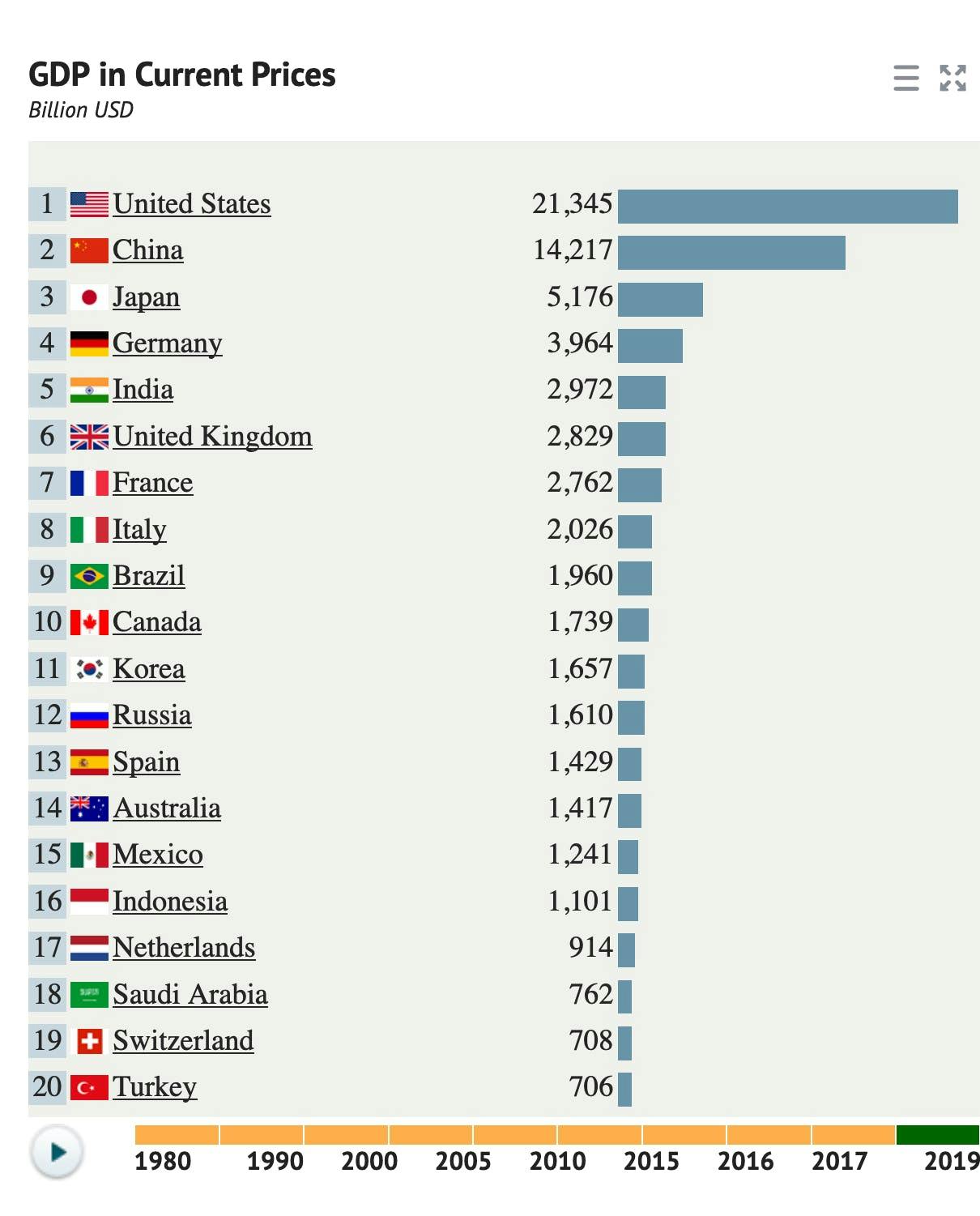

In terms of GDP Nominal, the US is still the largest economy in the world, with 2019 GDP at $21.3 trillion, compared with China’s $14.2 trillion. China is likely to overtake US by GDP Nominal by 2028.

According to economists, GDP purchasing-power-parity (PPP) compares different countries’ currencies through a market ‘basket of goods’ approach. Two currencies are in PPP when a market basket of goods (taking into account the exchange rate) is priced the same in both countries. For example, what goods 10 dollars can buy in the US, in China, or in Pakistan? Or, how much does a McDonald’s burger cost in the US versus its price in China?

Comparable developed countries rank higher in GDP Nominal while comparable developing countries rank higher in GDP PPP because prices of goods are cheaper in developing countries as a US dollar, for example, can buy more in China than in the US.

In 1980, the US GDP PPP was $2.9 trillion, nearly 10 times more than China while China was at merely $306 billion that year.

In 2018, China’s exports to the world accounted for $2.3 trillion. In 1985, the Chinese exports were only $27 billion, a fraction of today’s exports.

Another noteworthy example is China’s head-on war with extreme poverty. In 1981, 88% of Chinese population was extremely poor. Last year, only 3% Chinese population was under extreme poverty, according to a University of Oxford study.

Other more recent indicators of China’s economic rise:

The BIG: According to the Forbes 2019 ranking of world’s biggest public companies, five of world’s 10 biggest public companies are Chinese. Their ranking with 2019 market capitalisation:

1 ICBC $305 billion

3 China Construction Bank $225 billion

4 Agricultural Bank of China $197 billion

7 Ping An Insurance Group $220 billion

8 Bank of China $143 billion

Tech firms like Huawei, Alibaba and TenCent are also among the largest conglomerates in the world.

The Fortune 500: Similarly, the latest 2018 Fortune Global 500 ranking shows a shift in the world’s business landscape. Three of top four Fortune-500 firms are now Chinese. Their 2018 annual revenues:

2 State Grid $349 billion

3 Sinopec Group $327 billion

4 China National Petroleum $326 billion

The Largest: Similarly, six of the world’s 15 largest employers in 2018 were Chinese organisations. Their ranking and number of employees:

2 PLA 2.35 million

4 China National Petroleum Corporation 1.5 million

9 Foxconn 1.2 million

12 China Post 941,211

13 State Grid Corporation of China 926,067

14 Sinopec Group 713,288

The shippers: Another measure of world trade movement: Half of world’s top 20 container ports in 2019 are in China, according to Chinese Academy of Sciences (CAS) and World Shipping Council data. Shanghai is world’s biggest container port, with 37.1 million TEUs.

The out-bound tourists: The Chinese are already the world’s largest group of out-bound tourists. In 2017, they spent over $258 billion, 21 percent of the world market, according to United Nations World Tourism Organization (UNTWO).

How economic rise results in global influence

China’s economic rise has brought laurels to Chinese political leadership and President Xi Jinping is in the global spotlight. It also brought yuan into SDR basket of IMF currencies as the fifth global currency.

The Powerful: Another measure of influence and power: In 2018 annual ranking of The World’s Most Powerful People by American magazine, Forbes, President Xi Jinping seized the top spot.

This is for the first time ever that Xi clinched this spot, as Chinese CPC Congress removed term limits broadening his influence. Xi enjoys a cult of personality not seen since Chairman Mao, says Forbes.

Xi’s elevation to the world’s most powerful person unseated Russian President Vladimir Putin (#2), who held the top spot for an unprecedented four consecutive years. Putin has ruled Russia since May of 2000.

With the unprecedented economic development China could challenge the global financial system led by World Bank and IMF with influence from the USA. China-led AIIB and BRICS New Development Bank are examples of initiatives that signaled to the world that China was not willing to stay as a bystander and it needed its centre-stage presence, not accorded to China thus far.

The 2013 Belt and Road Initiative connecting 68 countries in Asia, Africa and Europe and with connectivity and infrastructure projects worth over $1 trillion is a landmark initiative, many comparing it with Marshall Plan, the postwar reconstruction plan by US.

China’s future economic status

With nearly $60 trillion in size, China will continue to be the world’s largest economy by GDP PPP in 2050, according to PwC, the world’s largest accounting firm.

The other measure through which economies are measured is GDP Nominal. China’s GDP stood at $13.4 trillion in 2018. By this number, China is world’s second largest economy after the US.

However, by GDP Nominal as well, China is set to become the world’s largest economy within this decade.

According to a study by Citigroup Inc, Number 30 in Fortune 500, China’s nominal GDP will reach $28 trillion by 2025 compared with $26 trillion for the US. This is based on anticipated growth rates and a gradual appreciation of the yuan to 5 per dollar from 6.8 now, says Citi.

According to Goldman Sachs, the world’s largest investment bank, China’s GDP will be at $52.6 trillion in 2050, nearly double the size of the US.

In years to come, 2019 could be viewed as a tipping point for global asset allocation, says a Bloomberg report. It says investors could send $3.36 trillion of new capital into China from abroad by 2025.

According to FT, as China opens its doors, assets sourced from Chinese clients could reach $9.3 trillion by 2023.

This earlier versions of this piece appeared in The News International, Pakistan’s largest-selling English-language daily.

Wali Zahid

Wali Zahid is a longtime China watcher and a Pakistan futurist. An award-winning journalist, he writes on issues of significance to Pakistan and CPEC & BRI.